Introduction to GST Registration

In India’s changing business world, GST Registration has become a crucial requirement for companies looking to grow. Whether you run a big company, a new startup, or work for yourself, it’s important to understand the goods and services tax. The introduction of GST Registration has made the tax system simpler by replacing many central and state taxes with one system. This not only makes paying taxes easier but also makes business operations more clear and efficient.

Let’s take a closer look at what you need, how the process works, and the valuable support available to make your GST Registration journey as smooth as possible.

Who Needs GST Registration?

Understanding if your business needs GST registration is an important first step in following the goods and services tax rules.

- Regular Businesses: If your business makes more than ₹40 lakhs a year (or ₹20 lakhs in certain special states), you need to register for GST. This rule helps smaller businesses by not making them follow all the GST rules.

- Service Providers: If you offer services and make more than ₹20 lakhs a year (or ₹10 lakhs in special states), you need to register. This includes freelancers and consultants who provide services that can be taxed.

- Businesses Selling Across States: If you sell goods or services to other states, you need to register for GST, no matter how much money you make. This helps make sure GST is applied fairly across different states.

- Occasional Sellers: If you sometimes sell taxable items in a state where you don’t have a regular business, you need to register. This might include people who organize events or do short-term work in different places.

- Foreign Businesses: If you’re from another country and sell goods or services in India without having a permanent office here, you need to register for GST. This makes sure both Indian and foreign businesses are treated the same way for tax purposes.

- Online Marketplaces: If you run a website where other people sell things, you need to register. This helps make sure GST is applied correctly to online sales.

- Businesses Paying Tax for Others: Some businesses have to pay tax for their suppliers. If your business does this, you need to register for GST.

- Previously Registered Businesses: If your business was registered under old tax systems like VAT or Service Tax, you need to switch to GST registration. This makes it easier to follow all the tax rules in one place.

Remember, registering for GST can seem complicated, but it’s an important step for many businesses. If you’re not sure whether you need to register, it’s a good idea to ask a tax expert for advice.

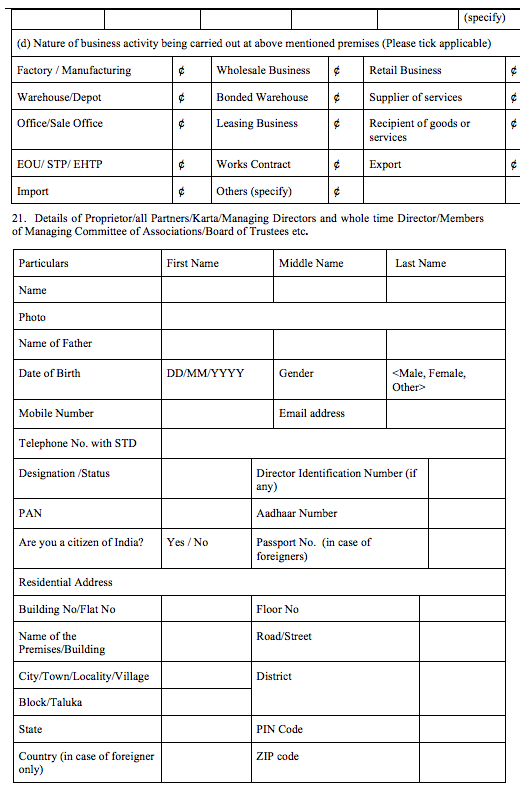

Getting Your GST Registration: Important Documents You Need

When you’re ready to register for GST, it’s important to have all your paperwork in order. Let’s go through the key documents you’ll need for GST registration:

- PAN Card: This is a must-have for all businesses. It’s your main ID for tax purposes.

- Aadhaar Card: If you’re the owner or the person signing for the business, you’ll need this to confirm who you are and where you live.

- Photos: Recent passport-sized pictures of the owner or signers. Make sure they’re in JPEG format and not too big (usually no more than 100 KB).

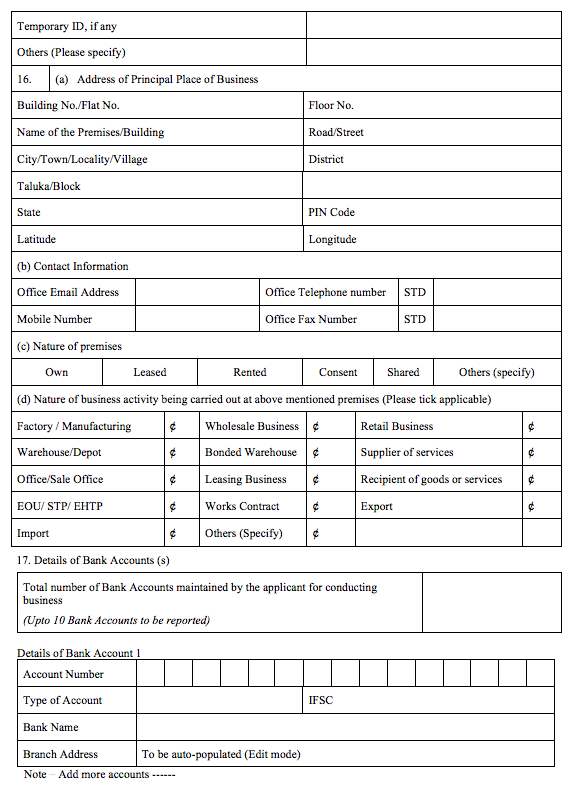

- Address Confirmation: If you own the place, your latest property tax receipt, municipal khata copy, or a recent electricity bill would be required. If you’re renting, you’ll need your rent agreement and an NOC letter from the landlord.

- Proof of Business:

- Single owner: Just your PAN and Aadhaar are enough.

- For Partnership: Your partnership agreement.

- For LLP: You’ll need your incorporation certificate and LLP agreement.

- For Company: Your incorporation certificate and company bylaws.

- Bank Details: A copy of your bank statement or a cancelled check.

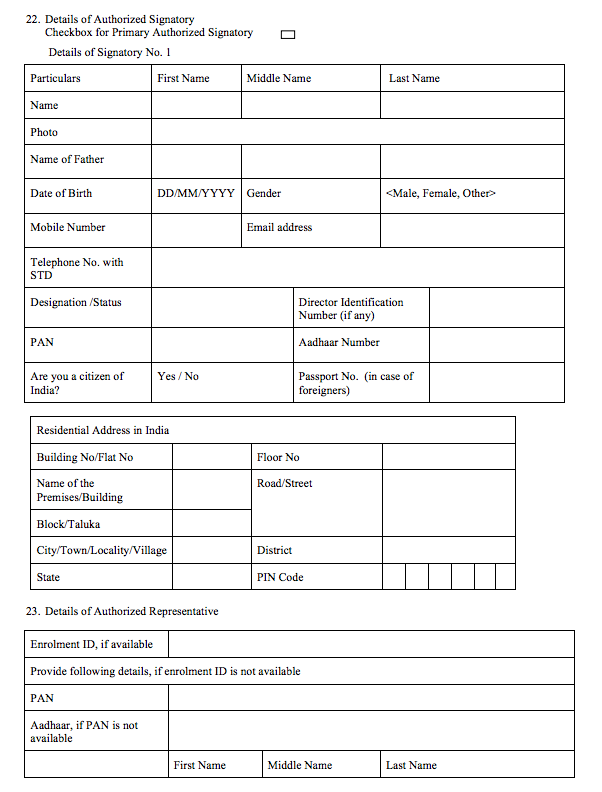

- Permission to Sign:

- GST Authorization Form: This shows who can sign GST documents for your business.

- Declaration for Authorized Signer: A formal statement saying who can act for the business.

- Extra Papers for Special Cases:

- For family businesses (HUF): The HUF’s PAN card and the head of family’s Aadhaar.

- For trusts and societies: Your registration certificate.

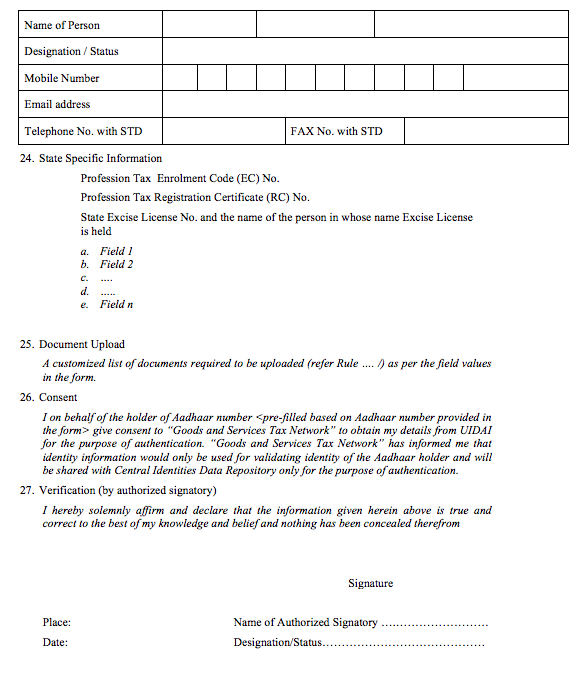

- Digital Signature: Depending on your business type, you might need a digital signature to sign your GST application online.

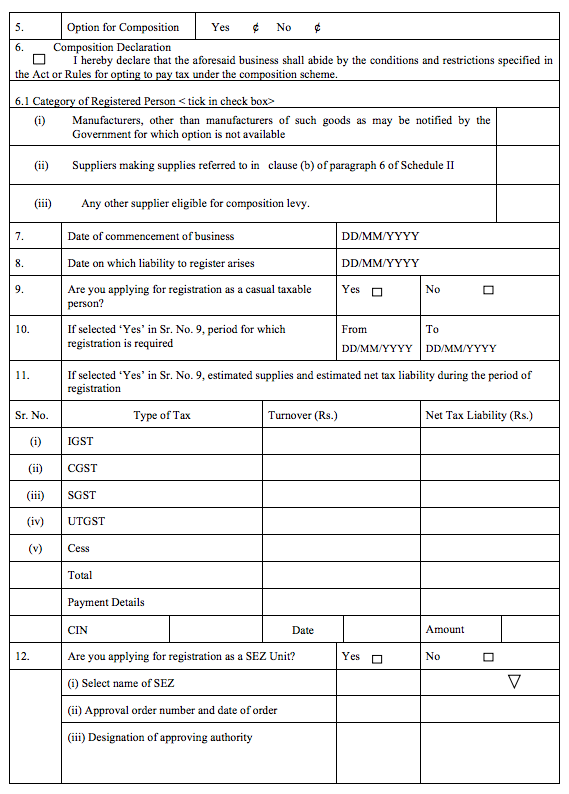

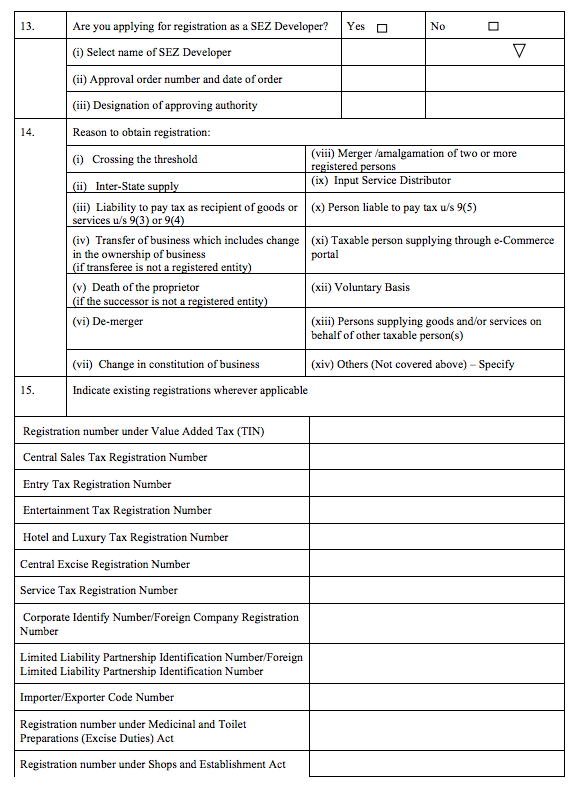

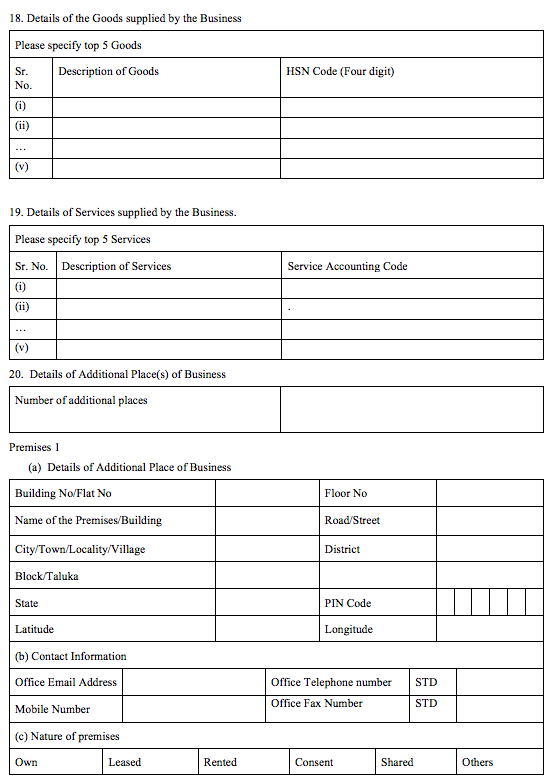

Steps to Getting Your Online GST Registration

Registering for GST might seem tricky at first, but don’t worry! We’ll break it down into easy steps to help you through the process.

1. Start at the Right Place

Head over to gst.gov.in. This is the official GST website where everything begins.

2. Begin Your Registration

Look for the ‘Services’ tab and click on ‘Registration’. Then, hit ‘New Registration’ to get started.

3. Fill Out the Basics (Part A)

- Enter your mobile number and email

- Choose your state

- Verify your details with OTPs sent to your phone and email

- You’ll get a Temporary Reference Number (TRN) – keep this safe!

4. Complete the Details (Part B)

Log back in using your TRN and fill out the rest:

- What your business does

- Where you mainly sell your goods or services

- What type of taxpayer you are

- How your business is set up (like a company or partnership)

- Upload necessary documents (make sure they’re clear!)

5. Sign It Off

The person in charge needs to sign the form. This can be done digitally or through Aadhaar.

6. Submit Your Application

Double-check everything and hit submit!

7. Keep Track

You’ll get an Application Reference Number (ARN). Use this to check your application status.

8. Wait for Approval

A GST officer will review your application. They might ask for more info if needed.

9. Get Your GST Certificate

If all goes well, you’ll receive your GST certificate with your unique GST Identification Number (GSTIN).

10. Start Using Your GST Registration

- Log into the GST portal with your new GSTIN

- File your returns on time

- Keep your business GST-compliant

Remember, this process is designed to be straightforward. If you’re stuck, don’t hesitate to ask for help.

GST Certificate and GSTIN: What You Need to Know

When you complete your GST registration, you’ll receive two important items:

- a GST Certificate and

- a Goods and Services Tax Identification Number (GSTIN).

These are crucial for operating under the GST system and help you stay compliant with tax laws.

Understanding Your GST Certificate

The GST Certificate is an official document from the Indian government. It shows that your business is registered for GST. This certificate includes important information about your business, such as its name and main address. It also displays your unique GSTIN and how long your registration is valid.

Why is this certificate important? It allows you to collect GST from customers and pay it to the government. You can also use it to claim tax credits on your purchases. Banks and government agencies often ask for this certificate when you apply for loans or bid on contracts.

Understanding GSTIN

Your GSTIN is a 15-character code that’s unique to your business. It’s used across all GST-related platforms and helps identify your business in the tax system. The GSTIN includes information about your business location and type.

This number is essential for conducting business across different states. It makes it easier to file tax returns and claim credits. The GSTIN also helps make your business operations more transparent, which can build trust with customers and partners.

Penalties for Not Getting GST Registration

The goods and services tax system is strict about making sure businesses follow the rules. Let’s break down the penalties you might face if you don’t comply:

1. Not Paying Enough GST:

If you don’t pay the full amount of GST you owe, you’ll have to pay a fine of 10% of the unpaid tax.

2. Trying to Avoid Paying Tax:

If you deliberately try to avoid paying GST, you could be fined up to 100% of the tax you tried to avoid.

3. Registering Late:

If you don’t register for GST on time, you’ll have to pay a late fee. This is usually ₹200 for each day you’re late, up to a certain limit.

4. Not Filing GST Returns:

Not filing GST returns regularly, can attract fines between 10% and 100% of the tax due, depending on how serious the mistake is.

5. Giving Wrong Information:

If you provide incorrect or incomplete information when registering for GST or filing returns, you might have to pay fines.

6. Serious Offenses:

For very serious cases of not following the rules, you might even face legal action. This could lead to imprisonment.

7. Extra Interest Charges:

Besides fines, you’ll also have to pay interest on any late GST payments. The interest rate is usually 18% per year on the unpaid amount.

The Importance of GST Registration – Conclusion

GST registration is a key step for businesses in India looking to grow and stay compliant. It’s not just about following the law – it brings real benefits like input tax credits, better cash flow, and increased trust from customers and partners.

While the process might seem tricky at first, with the right help, it can actually give your business a leg up in the market. Whether you’re just starting out or have been around for years, GST registration can help your business thrive.

Why Choose MAHESHWARI & CO. for GST Registration

At MAHESHWARI & CO., we know GST registration inside and out. Our team of experts is here to make the process smooth and stress-free for you. We don’t just fill out forms – we take the time to understand your business and offer advice tailored to your needs.

From start to finish, we’re by your side, helping with the initial registration and keeping you up to date on any changes to goods and services tax rules. With MAHESHWARI & CO., you’re not just getting a service – you’re gaining a partner committed to your business success.

Frequently Asked Questions (FAQs):

1. What is GST Registration and who needs to register?

GST Registration is a mandatory process for businesses in India whose annual turnover exceeds specified thresholds or fall under certain categories. It applies to service providers, traders, manufacturers, freelancers, and e-commerce operators. Additionally, entities involved in inter-state supplies, casual taxable persons, and non-resident taxable persons must register irrespective of their turnover.

2. What documents are required for Online GST Registration?

- The essential documents for Online GST Registration include:

- PAN card of the business owner or entity

- Aadhaar card of the proprietor or authorized signatory

- Photographs in JPEG format

- Proof of business address (rental agreement or ownership documents)

- Bank account details with IFSC code

- Partnership deed or incorporation certificate (for firms and companies)

- GST Authorisation Form and Declaration for Authorized Signatory

3. What are the benefits of obtaining GST Registration?

GST Registration offers numerous advantages, such as:

- Legal compliance and avoidance of penalties

- Eligibility for Input Tax Credit

- Simplified interstate trade and elimination of the cascading effect of taxes

- Enhanced credibility and access to larger markets

- Optimized cash flow and improved credit rating

- Streamlined online compliance and transparent operations

4. How long does the GST Registration process take?

The GST Registration process typically takes between 3 to 7 working days after submitting a complete and accurate application. This duration may vary if additional documents or clarifications are required by the GST authorities.

5. What penalties apply for not obtaining GST Registration?

Failure to obtain GST Registration when required can lead to significant penalties:

- Non-Payment or Underpayments: A penalty of 10% of the outstanding tax amount.

- Intentional Tax Evasion: A penalty equal to 100% of the evaded tax amount.

- Additionally, continuous non-compliance can result in further legal actions and increased scrutiny from tax authorities.